The 7-Second Trick For Fortitude Financial Group

Table of ContentsThe smart Trick of Fortitude Financial Group That Nobody is Talking About6 Easy Facts About Fortitude Financial Group ExplainedThe Only Guide for Fortitude Financial GroupAll About Fortitude Financial GroupThe Main Principles Of Fortitude Financial Group

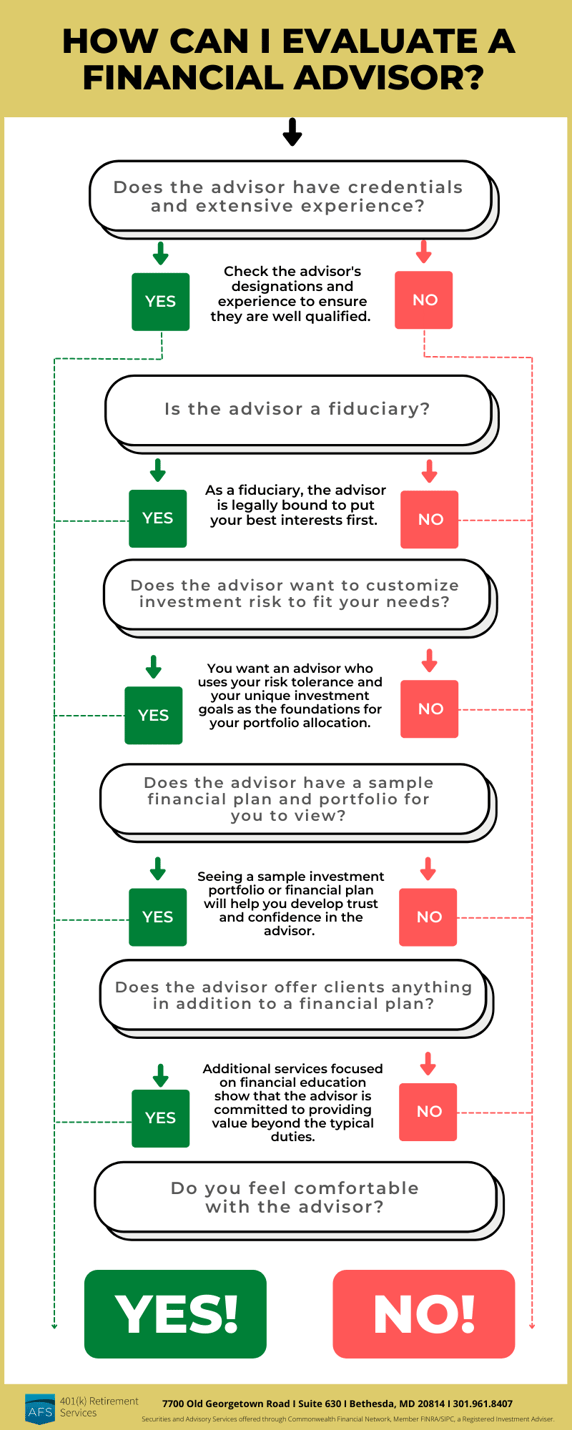

Note that lots of experts won't handle your possessions unless you meet their minimal demands (Investment Planners in St. Petersburg, Florida). This number can be as low as $25,000, or reach into the millions for the most special advisors. When picking a financial expert, learn if the specific complies with the fiduciary or suitability criterion. As noted previously, the SEC holds all consultants signed up with the agency to a fiduciary criterion.The wide area of robos extends platforms with access to monetary consultants and financial investment administration. If you're comfy with an all-digital system, Wealthfront is another robo-advisor alternative.

You can discover a financial consultant to aid with any type of facet of your financial life. Financial experts may run their own company or they could be component of a bigger office or financial institution. No matter, an advisor can aid you with everything from developing an economic strategy to spending your cash.

Getting My Fortitude Financial Group To Work

Think about working with a monetary advisor as you create or modify your economic strategy. Discovering a monetary consultant doesn't need to be hard. SmartAsset's totally free tool suits you with approximately three vetted financial experts that serve your area, and you can have a free initial telephone call with your expert matches to decide which one you really feel is best for you. Inspect that their certifications and skills match the services you desire out of your consultant. Do you want to learn more concerning economic consultants?, that covers principles surrounding accuracy, dependability, editorial independence, competence and objectivity.

Most people have some psychological link to their money or the things they acquire with it. This psychological connection can be a primary factor why we may make poor economic choices. A professional financial expert takes the feeling out of the equation by giving unbiased suggestions based upon understanding and training.

Fortitude Financial Group Fundamentals Explained

The fundamentals of financial investment monitoring include purchasing and marketing financial assets and other financial investments, however it is more than that. Managing your investments includes comprehending your brief- and lasting objectives and using that information to make thoughtful investing decisions. A monetary consultant can give the information necessary to help you diversify your investment portfolio to match your desired level of threat and meet your financial goals.

Budgeting offers you an overview to just how much cash you can invest and exactly how much you must conserve monthly. Complying with a budget plan will help you reach your short- and long-term economic objectives. A monetary consultant can assist you detail the action steps to take to set up and keep a budget plan that helps you.

In some cases a medical costs or home fixing can all of a sudden add to your debt load. A specialist financial debt administration plan aids you repay that financial obligation in one of the most financially advantageous method possible. A financial expert can assist you evaluate your financial debt, focus on a debt settlement method, offer alternatives for financial obligation restructuring, and describe an all natural plan to better take care of financial obligation and fulfill your future monetary goals.

The Definitive Guide for Fortitude Financial Group

Individual cash circulation evaluation can inform you when you can afford to get a brand-new automobile or how much money you can contribute to your financial savings each month without running short for necessary costs (St. Petersburg, FL, Financial Advising Service). A financial advisor can help you clearly see where you spend your money and after that use that understanding to aid you recognize your financial wellness and exactly how to enhance it

Danger administration solutions recognize prospective dangers to your home, your automobile, and your household, and they assist you put the ideal insurance plan in position to alleviate those dangers. A monetary consultant can help you develop a technique to safeguard your earning power and reduce losses when unanticipated points occur.

The 9-Minute Rule for Fortitude Financial Group

Reducing your taxes leaves more cash to add to your investments. St. Petersburg Investment Tax Planning Service. An economic expert can aid you utilize philanthropic providing and financial investment methods to decrease the quantity you need to pay in taxes, and they can show you how to withdraw your money in retired life in a manner that additionally decreases your tax obligation problem

Even if you didn't begin early, college planning can help you place your kid with college without facing unexpectedly huge expenses. A financial advisor can lead you in recognizing the ideal means to save for future university expenses and how to fund potential voids, describe how to reduce out-of-pocket university costs, and encourage you on eligibility for financial assistance and grants.

Comments on “8 Simple Techniques For Fortitude Financial Group”